45L Multi-Family Worksheet

Multi-Family (MF) buildings must qualify for the 45L Tax credit as individual dwelling units. When one dwelling unit is modeled per zone CHEERS automatically converts the MF plan to individual dwelling units and then calculates 45L eligibility using the MICROPAS Tax Credit software.

When a MF plan is modeled using multiple dwelling units per single zone the features for each dwelling unit cannot be automatically determined. Therefore, additional guidance is needed to separate each feature to its appropriate dwelling unit.

The 45L Multi-Family Worksheet provides a list of features whose “Areas” cannot be automatically determined. Carefully review each feature and modify the areas as necessary. Provided below are some examples.

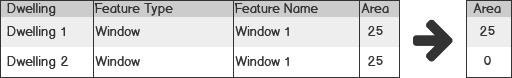

Example 1 – Assign window to single dwelling

Assume there are two dwelling units, ‘Dwelling 1’ and ‘Dwelling 2’ in a single zone. ‘Window 1’ is 25 sq ft and should only exist in ‘Dwelling 1’. Because the converter does not know which dwelling unit the windows belongs to, ‘Window 1’ will be listed under both ‘Dwelling 1’ AND ‘Dwelling 2’. To accurately assign ‘Window 1’ to ‘Dwelling 1’ leave the area for ‘Window 1’ ‘Dwelling 1’ at 25 and change the area from 25 to 0 for ‘Window 1’ ‘Dwelling 2’.

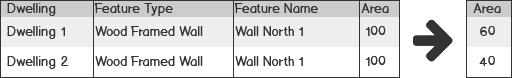

Example 2 – Split wall areas for two dwellings

Assume there are two dwelling units, ‘Dwelling 1’ and ‘Dwelling 2’ in a single zone. The plan models a single wall representing the combined areas of the two dwelling units for the north wall as ‘Wall North 1’. In this example applying a value of zero for ‘Wall North 1’ in either dwelling is not appropriate. The areas should be split out between ‘Wall North 1’ for each dwelling unit. In this example let’s say that Dwelling 1, Wall North 1 should be 60 and Dwelling 2, Wall North 1 should be 40. The total combined area should be 100 but is split out 60 and 40 respectively.