45L tax credit for energy efficient homes

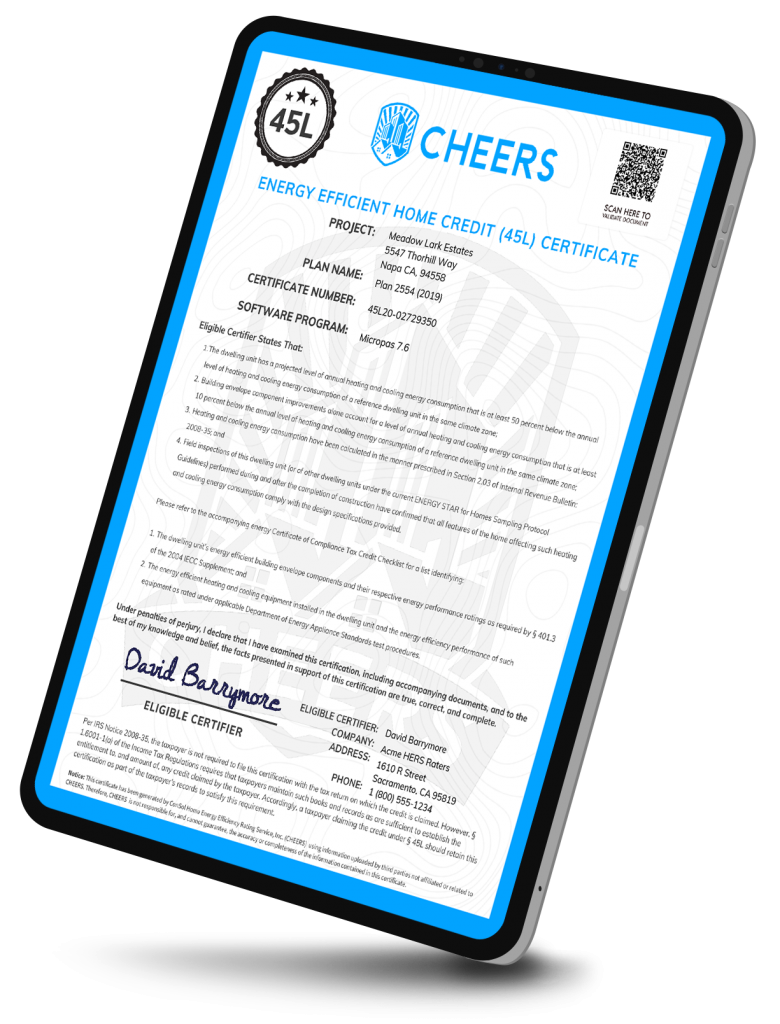

Create certificates for the $2,000 45L tax credit. Projects registered with CHEERS are automatically evaluated for energy savings eligibility with Micropas, a U.S. Department of Energy approved 45L software.

Why use CHEERS for 45L?

45L Plan Pre-Qualification

- A value add for Energy Consultants and Designers to their builder clients

- Documentation demonstrates the energy plan design will be eligible for the $2,000 45L tax credit when constructed

45L Certificate Package

- HERS Raters create and sign the 45L certificate as the Eligible Certifier

- Builders use this package as supporting documentation when claiming the $2,000 tax credit

- Typical fee to builder to complete tax credit work is $200-$500 per lot. This includes the CHEERS certification package

Customized Pricing

- Design a custom package for your business

- Available for businesses with large 45L or registry volume

- Volume discounts, multi-product discounts; contact us for a quote

45L tax credit overview

Under the provisions of the 45L New Energy Efficient Home Tax Credit, builders and developers may claim a $2,000 federal tax credit for each new home or dwelling unit that meets 45L energy efficiency requirements. Most new California homes qualify for this $2,000 credit.

The California 45L process

CHEERS is California’s largest registry for California Building Energy Code (Title 24) compliance. Each project uploaded to CHEERS for energy code registration is instantly evaluated for 45L qualification via Micropas, a Department of Energy approved 45L software. A 45L certificate package is made available for review and download if the project meets the 45L energy savings requirements.

45L tax credit basics

The 45L credit is federal tax incentive that promotes the construction of energy efficient residential buildings. The credit is available to builders, developers and others who build homes for sale or lease.

To qualify for the $2,000 tax credit, an eligible “dwelling” must:

- Be at least 50% more efficient than the 2006 IECC benchmark. Efficiency compliance must be verified with DOE approved 45L software, such as Micropas.

- Have the energy features verified by a qualified HERS Rater (Eligible Certifier)

- Be sold or leased prior to January 1, 2023

Most California residential building projects qualify for this credit by building to current California code. California’s progressive Building Energy Code (Title 24) is substantially more stringent than 2006 IECC.

45L in CHEERS for

Energy Consultants:

Energy Consultants:

45L in CHEERS for

HERS Raters:

HERS Raters:

Frequently asked questions

CHEERS does not provide tax or accounting advice. Please consult with your tax and accounting advisors for 45L guidance specific to your situation.